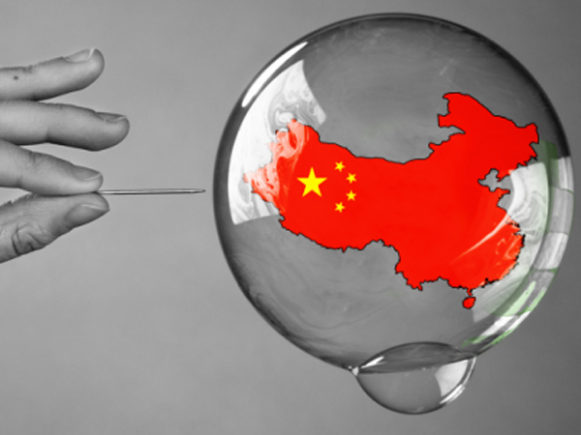

Global house markets have been thoroughly affected by the China stock market crash over the past weeks, with clear numbers showing decelerating price growth in many regions of the world.

In a recent article on globalresearch.ca, Greece used to be the center of the world’s concern, over its struggles with economic and political issues. With China showing some weakness in the stock market, these global markets try their best to show strength in their own respective domains. The Global Property Guide gives consumers what these markets are experiencing in other parts of the world.

In another report on propertywire.com, Hong Kong made a 20.7% house price growth while China, on the other hand, went down to 5.7%. This was mostly evident with rich Chinese investors heading towards Hong Kong’s residential sector, giving the boost it needed. Kate Everett-Allen, International Residential Research Head for Knight Frank, said “The recent volatility in the Chinese stock market has underlined the fragility of the Eurozone’s recovery and has pushed the likelihood of a rate rise by the US Federal Reserve further back which is good news for home owners in the US and beyond but bad news for corporate balance sheets.

Read More @ http://www.realtytoday.com/articles/33728/20150909/a-look-at-worldwide-house-market-predictions-for-2015.htm