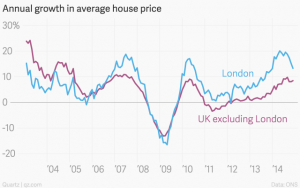

Over the past few years, Londoners, from Shepherd’s Bush to Stratford, have been shocked by the house prices . Many potential buyers who had hoped that signs of a slowdown ,that emerged in the summer ,would continue, and so it has . But what exactly is a slowdown for a market that has been outperforming for the last years ?

The slowdown—meaning prices are still increasing, but less fast than before—offers a very small reprieve to the capital’s house hunters. The price of the average London home rose by around 13% in December, according to the latest data from the Office of National Statistics. That’s down from a 20%-per-year pace not long ago:

annual-growth-in-average-house-price-uk-excluding-london-london_chartbuilder-1

Looking ahead, many market watchers reckon that London property prices could actually fall this year—in part because they have risen so far, so fast in the recent past. Still, a 3% decline in the average London house price in 2015, (as predicted by the Centre for Economics and Business Research), will not suddenly make London much more affordable.

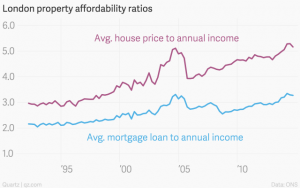

Put simply, the supply of new houses is not keeping up with demand, which will keep prices high. At the same time, weak wage growth has made it harder for people to keep up with modest price increases, much less the breakneck growth of London house prices in recent years.

As a ratio to the average homebuyer’s income, both prices and the size of mortgages are hovering back where they were during the bubbliest point of the pre-crisis period:

london-property-affordability-ratios-avg-house-price-to-annual-income-avg-mortgage-loan-to-annual-income_chartbuilder

Britain is facing a housing crisis – and the solution is more affordable homes. But as the latest government figures show, we’re still falling far short of building the number of new homes needed.

Although last year house building in England rose by 10% to 137,000, that figure is 25% down on 2007 levels. These numbers are just over half of what housing campaigners estimate that contractors should be building to make a dent in the housing shortage.

97507322_82cdb9dce6_b

Real estate markets are always affected on the short to medium term by macroeconomics, demographics as well as political changes. The mood of buyers and vendors alike in the prime London residential market is likely to remain subdued up until after the general election in May according to Taylor Scott International’s analysts. Uncertainty surrounding a potential mansion tax, interest rates and the introduction of capital gains tax liability for non-resident owners are also contributing to the general market angst. Moreover, a tightening mortgage regulatory environment with the European Mortgage Credit Directive due for implementation by 2016 and the Basel III requirements by 2019 on top of recent new UK rules, may see lenders become more cautious. The UK elections, the European union member countries major financial and relationship issues, fears over a Greek exit from the euro zone, the price of oil , the Russian politics and so many other factors , do affect the market. Nevertheless the UK property market has shown over the years that it has a very strong foundation, based in a very strong economy. While the pound hits a new 7 years high against the euro and the British Chambers of Commerce is upgrading the country’s growth forecast despite slowdown in investment, a GDP of $3.002 trillion (Nominal, 2015) is expected and the flexibility of having its own currency in the eurozone, the property market was expected to slowdown . The property market especially down town London has reached astronomical prices and a correction was necessary.

The overall outlook for the market is that it remains still strong. The slowdown—meaning prices are still increasing, but less fast than before will affect mainly the prime time properties in down town London .The demand for housing remains extremely high in the capital’s region.Investors should be , as always , very careful before investing in any property and follow up with the market changes.

Writen by Kosta Kioleoglou REValuer (Tegova) Director of Engineering , Valuations and Appraisal for Taylor Scott International